Technical Analysis Suggests a Stock Market Crash Could Be Ahead

A stock market crash is starting to become a likely scenario. Investors beware.

Understand that sentiment drives everything. If investors become pessimistic, they sell.

When we look at the price action of key stock indices, it suggests that investor sentiment is turning dismal and that a stock market crash could become reality sooner rather than later.

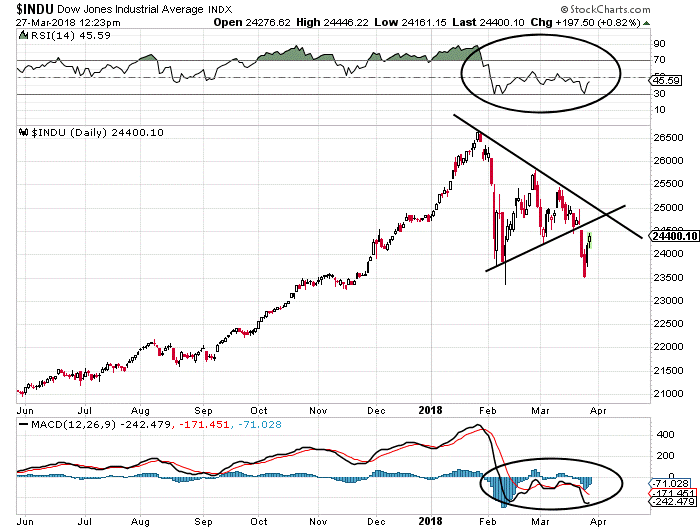

Look at the chart below of the Dow Jones Industrial Average and pay close attention to the lines drawn on it.

Chart courtesy of StockCharts.com

You see, over the past few weeks, we have been seeing a symmetrical triangle pattern forming on the Dow Jones Industrial Average stock chart. Symmetrical triangle patterns form when there’s a prevailing downtrend and uptrend and—at the same time—the price range is consolidating.

Here’s the interesting part: a symmetrical triangle pattern is one of those patterns in which the direction isn’t known until the point where the price breaks above or below the triangle, which is called the breakout point.

The Dow Jones has just broken below the triangle. This is taken as a very bearish sign by technical analysts.

Remember that every chart pattern usually has targets associated with it. With a symmetrical triangle, technical analysts usually take the widest part of the triangle and add that range to the breakout point, be it to the upside or the downside.

The widest part, in this case, was about 2,859 points.

From here, it’s simple math: if we subtract 2,859 points from the breakout point of 24,574, we could be seeing the Dow Jones Industrial Average dropping to as low as 21,715 points.

That is roughly 11.6% below where it currently sits.

If the Dow Breaks Lower, Massive Selling Could Follow

But don’t get too far ahead just yet. If the 21,715 level is reached, it would also mean that the Dow Jones Industrial Average has broken below its 200-day moving average.

Dear reader, let me just tell you that, when the 200-day moving average breaks, the “big guns” come out.

Why? Because the 200-day moving average is considered a long-term trend indicator by technical analysts and traders. Usually, when the price of an asset breaks below this average, traders take on bearish bets rather than bullish ones. So, this could be the case for the Dow as well, and we could see it drop further.

3 Things to Do in the Case of a Sell-Off

Going forward, it’s important to watch the markets very closely.

Lombardi Letter has warned its readers over the past few months that we could be headed for a stock market crash. We have talked about sell-offs when everyone else was turning extremely bullish and forecasting the key stock indices shooting through the roof.

With all this said, we believe that, at this point, there are three things that investors could be doing:

- Focus on capital preservation. This means setting stops and taking some profits off the table.

- Follow markets closely. They have been wild for a while, and trading ranges could get extreme.

- Go bargain hunting. In times of a sell-off, investors sell anything and everything in sight. They sell companies with great fundamentals. So it might be the time to look for opportunities.